LVMH: Navigating the Cycle, Positioned for the Rebound

Muffett Investments — September 2025

Executive Summary: A Compelling Long-Term Opportunity

LVMH, the world's leading luxury goods conglomer, is demonstrating resilience amidst a sector-wide normalization. Following a post-pandemic surge, 2024 was a reset year, with revenue and profits moderating from record highs. However, the company's core strengths remain undiminished: legendary brand desirability (Louis Vuitton, Dior, Tiffany), a fortress balance sheet, and immense cash flow generation.

While the first half of 2025 confirmed a softer demand environment, particularly in Asia, it also highlighted LVMH's ability to maintain robust profitability and navigate downturns from a position of strength. The significant de-rating of the stock price in 2024 has created a more attractive entry point for long-term investors.

Our Thesis: We initiate coverage of LVMH with a BUY rating. The current cyclical slowdown presents a strategic opportunity to invest in a high-quality compounder. We anticipate a return to growth driven by the company's unparalleled brand portfolio and a potential catalyst from the "Gold Price Wealth Effect" in key Asian markets.

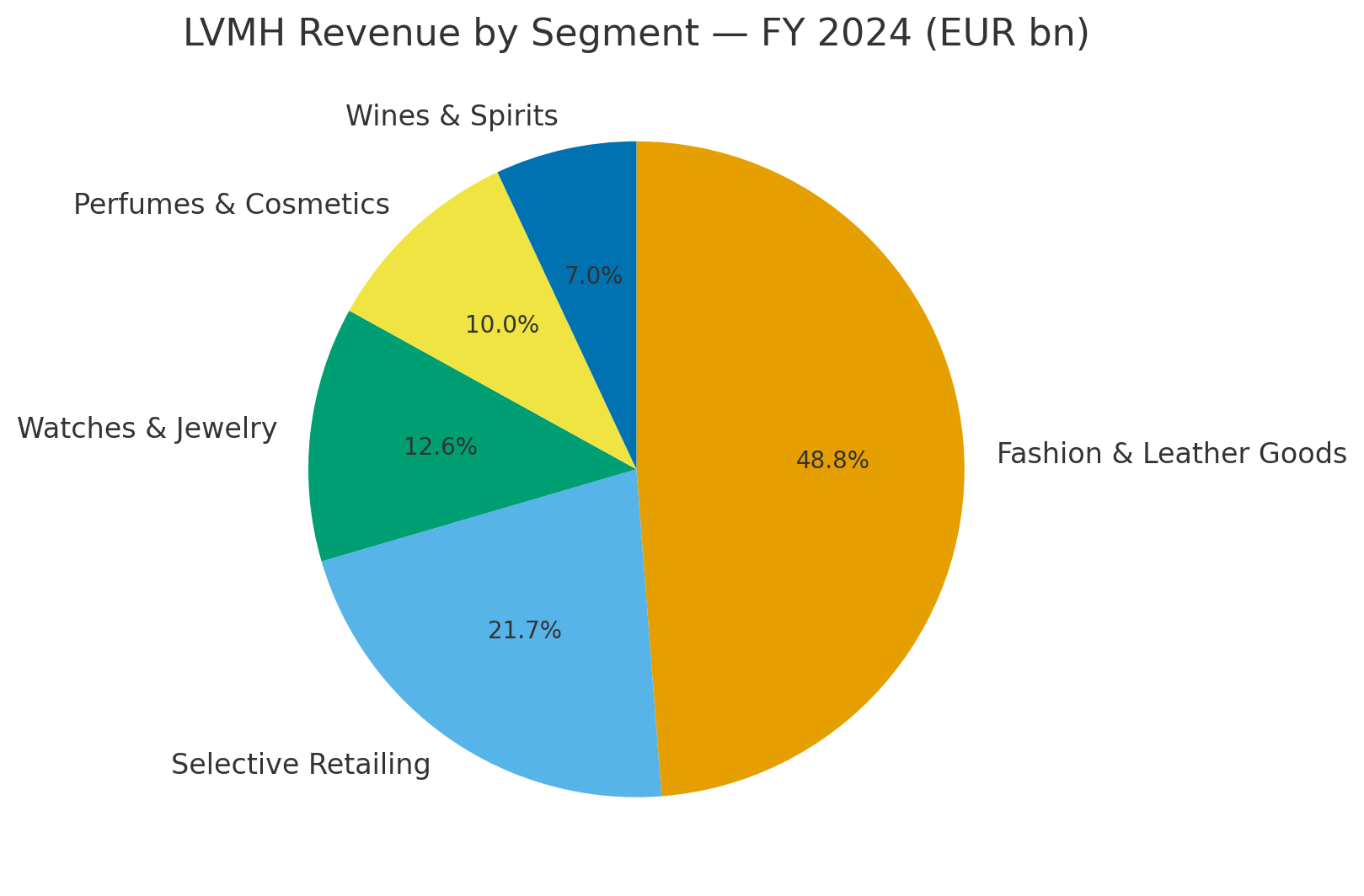

Segment Performance: A Tale of Cyclical Headwinds and Structural Strengths

LVMH's diversified business model provides stability, with different segments navigating the economic climate in various ways.

Fashion & Leather Goods (The Crown Jewel): Revenue softened in 2024 and H1 2025 as the post-pandemic boom normalized. This was driven by less tourist spending and more cautious aspirational spending in Asia. Crucially, despite the top-line pressure, profitability remains best-in-class (34.7% margin in H1 2025), proving the enduring pricing power of Louis Vuitton and Dior.

Watches & Jewelry (The Growth Optionality): This segment has held steady, supported by iconic lines and ongoing store renovations for Tiffany & Co. It is the primary beneficiary of our "Gold Price Wealth Effect" thesis, positioning it for a potential powerful upswing.

Wines & Spirits (The Cyclical Trough): This has been the weakest segment, with demand for Cognac slowing significantly in the U.S. and China due to inventory adjustments and economic pressures. However, we see signs of a bottom, with improving Champagne trends in Q2 2025.

Selective Retailing (The Steady Outperformer): Sephora continues to be a powerhouse, gaining market share globally through its compelling mix of brands and omnichannel strategy. Its consistent growth provides a reliable earnings buffer.

Perfumes & Cosmetics (The Stable Innovator): This segment is stable, leveraging innovation to offset softer demand in some regions.

The Catalyst: The "Gold Price Wealth Effect" in China & India

A unique macroeconomic factor could serve as a powerful tailwind for LVMH's recovery, specifically in its high-margin Watches & Jewelry segment. Over the last 2 years, the Chinese housing market is in a controlled deflation mode as the chinese government reins in excessive speculation in real estate. This has reduced the consumer spending in China. However this is set to change as China embarks on a more stimulative policy to encourage domestic spending. LVMH combined Asia sales contributes to 36% of the total revenue. So increased spending in china and India will translate into increased revenues.

The Insight: Chinese and Indian households each hold an estimated 25,000 tonnes of gold. As global gold prices rise, this creates a significant "wealth effect"—households feel richer without selling their gold. Gold is currently trading at $3820 which is more than twice that of last year. We expect gold price to continue to rise over the next few years with a potential target of $10,000. This will lead to shift in wealth from the west to the east. This would be one of the big premises of this investment.

The Transmission to Luxury Spending:

We speculate this perceived wealth increase could catalyze spending in three ways:

Conversion: Households may be more inclined to convert "stored wealth" (gold bullion) into "worn wealth" (high-end jewelry from Tiffany or Bulgari).

Gifting: Key cultural occasions like weddings and festivals could see a boost in gifting budgets, directly benefiting hard luxury.

Confidence: A stronger household balance sheet can restore consumer confidence, encouraging spending on aspirational items across LVMH's portfolio.

While this will not erase broader macroeconomic concerns in China, it provides a plausible path for a re-acceleration in luxury demand in H2 2025 and into 2026, with LVMH's Watches & Jewelry division positioned to capture the lion's share of this upside.

Valuation & Conclusion: Why We See Value

After a near 40% share price decline from all time highs, LVMH's valuation has become more compelling. At the current price of €620, the stock is trading at a Price-to-Earnings (P/E) ratio of approximately 23, a significant de-rating from its peak. This suggests the market is pricing in a prolonged slowdown, potentially overlooking LVMH's resilient brand equity and future growth levers.

Final View: BUY

LVMH is not a cheap stock, but it is a premium asset trading at a more reasonable price. The company's unparalleled collection of brands, disciplined management, and formidable cash flow generation make it a high-quality compounder for the long term.

The current cyclical downturn is a feature of the luxury market, not a bug. For investors with a multi-year horizon, we believe this period of softness is an opportunity to build a position in a global leader, with a clear and speculative catalyst for recovery on the horizon.